The Bexar County Tax Assessor-Collector’s Office urges property owners using the Half-Payment Plan to meet the December 1st deadline, aiding budget flexibility.

BEXAR COUNTY, Texas — The Bexar County Tax Assessor-Collector’s Office is reminding property owners that plan to use the county’s popular Half-Payment Plan that the first payment deadline for the 2025 tax year is Monday.

The program allows taxpayers to split their bill into two equal payments. The second half-payment isn’t due until June 30, 2026, giving residents more time to budget and avoid a single large payment early in the year.

“Our Property Tax Half-Payment Plan is a way to help our citizens budget their money and to help make paying their property taxes easier,” Uresti said. “It allows our citizens to pay their taxes in two equal payments instead of one lump sum. The mission of the Bexar County Tax Assessor-Collector’s Office is ‘To Help Keep Families in their Homes.’ The Half-Payment Plan is one of the tools we use to help with this mission.”

The option continues to grow in popularity—about 75,000 taxpayers enrolled last year, including both residential and commercial property owners who do not have mortgage escrow accounts.

Residents who do not participate in the Half-Payment, 10-Month, or Quarter Payment Plans must pay their 2025 property taxes in full by Jan. 31, 2026.

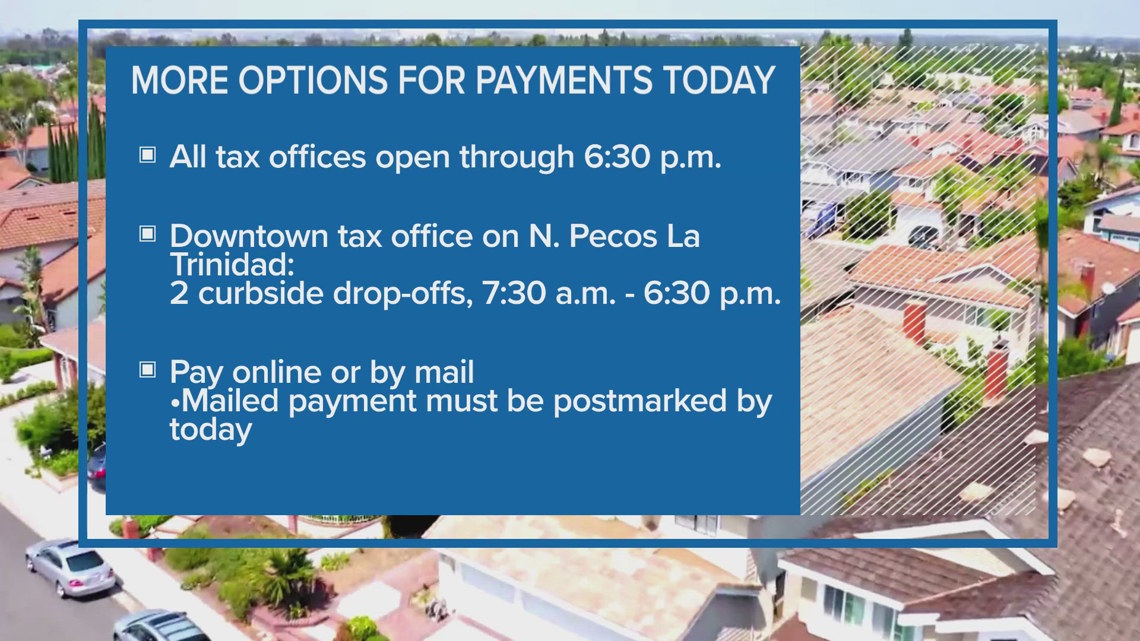

To help meet the December deadline, all Bexar County Tax Office locations will remain open until 6:30 p.m. on Monday, Dec. 1. Homeowners can pay in person, online, or by mail. Payments sent through the mail must be postmarked by Dec. 1 to be considered on time.

The downtown Tax Office at 233 N. Pecos La Trinidad will offer two curbside drop-off lanes from 7:30 a.m. to 6:30 p.m. The Northeast and Northwest substations will have curbside drop-off available 2:30–6:30 p.m. Southside and Rocket Lane locations will keep their drive-thru lanes open all day until 6:30 p.m.

All Tax Office locations also provide secure drop-boxes for after-hours payments.

You can check your tax balance or read more about payment options by visiting bexar.org/tax or by calling (210) 335-2251. Credit card and electronic check payments can be made online or by phone at 1-888-852-3572. Taxpayers should have their account number ready.