If voters approve Props 11 and 13, homeowners could save hundreds of dollars in property taxes every year.

HOUSTON — Texans could soon see some of the biggest property tax breaks in state history — but only if voters say “yes” to a couple of propositions on the ballot.

Supporters say the proposed constitutional amendments — Props 11 and 13 — would deliver real savings for millions of homeowners across the state.

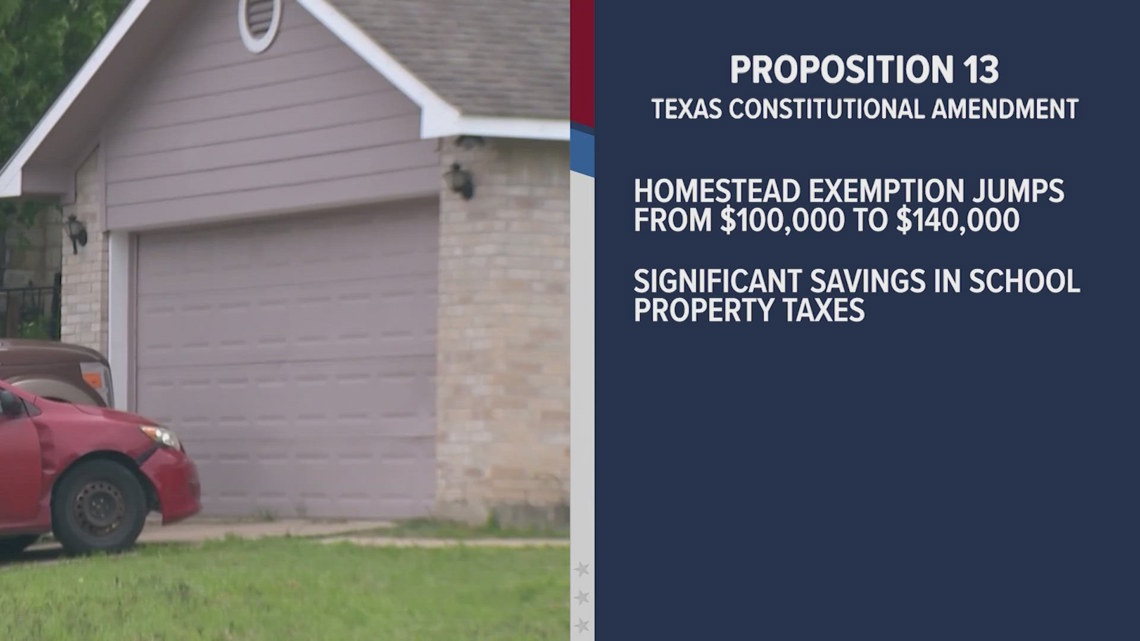

What Proposition 13 would do

Prop 13 would raise the homestead exemption — the portion of a home’s value that can’t be taxed — from $100,000 to $140,000 for all Texas homeowners.

State Senator Paul Bettencourt of Houston, who authored the legislation, said the change translates into significant yearly savings for homeowners.

“That’s going to save you about $484 a year, for as long as you own the home,” Bettencourt estimates.

What Proposition 11 would do

Prop 11 targets additional relief for seniors 65 and older and disabled Texans by raising their exemptions from $10,000 to $60,000.

That means eligible Texans would see a combined $200,000 in total exemptions, potentially wiping out school district property taxes entirely.

“Some Texas seniors will be paying zero ISD property taxes if this passes,” Bettencourt said. “There’s no number lower than zero — that’s real relief.”

Historic exemptions compared nationally

If approved, Bettencourt says these exemptions would be the largest in the country.

For comparison, Florida homeowners currently receive only about a $50,000 homestead exemption — far less than what Texas is proposing.

“These are all record numbers — record in Texas and record around the country,” Bettencourt said.

When would they take effect?

Voters wouldn’t have to wait long to feel the impact. Bettencourt says the relief would show up immediately on this year’s property tax bills.

“People realize that when exemptions go up, tax bills go down — and everyone needs that break,” he said.

Who pays for it?

The state would be responsible for reimbursing school districts for the lost revenue caused by the expanded exemptions.

There’s currently no organized opposition to Propositions 11 and 13, but some critics worry whether Texas can sustain this level of relief long term.

Still, Bettencourt says he’s confident voters will approve the measures.

“I expect it to pass — but I’m not taking it for granted,” he said. “I’m communicating with people so they don’t miss that opportunity.”

The last day of early voting is Friday, October 31. The election is on Tuesday, November 4.