Texas families are gearing up for back-to-school shopping during tax-free weekend — and one mom’s real-life savings show how quickly it adds up.

HOUSTON — Back-to-school shopping can add up fast, especially when you’re buying for more than one child. But this weekend, Texas families are getting a break at the register thanks to the state’s annual sales tax holiday.

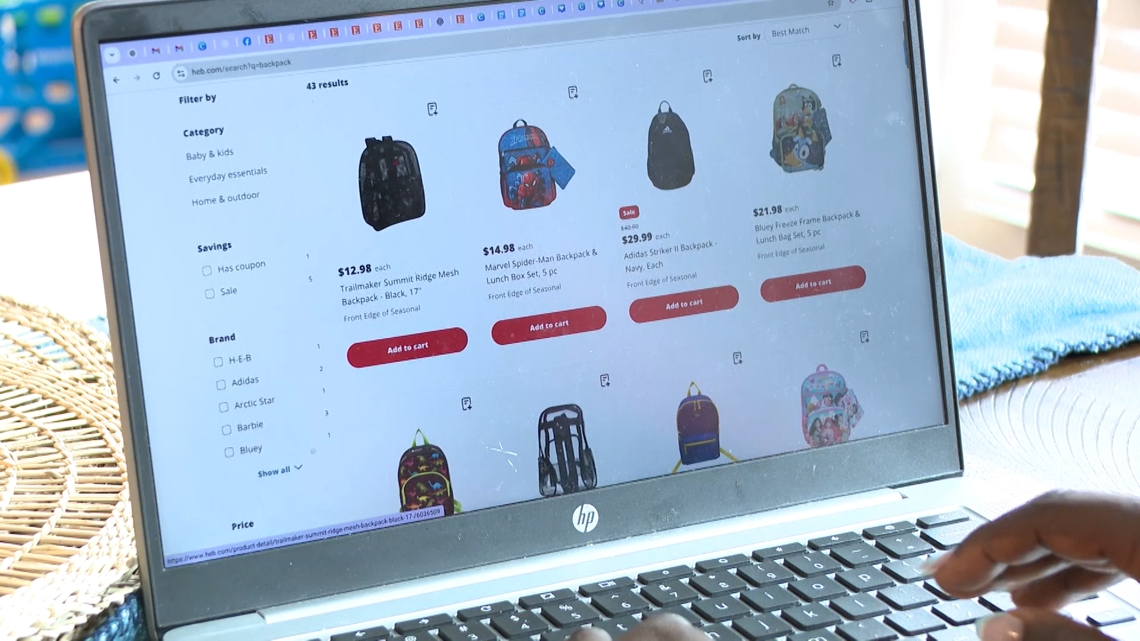

To see just how much families can save, we sat down with Houston mom Ebony London, as she shopped for not one, but two young learners: a preschooler and a kindergartner.

“They’re into everything,” London laughed, as she watched her kids play with magnet blocks and Play-Doh. “But she loves Play-Doh and magnet blocks.”

For Ebony, shopping for school supplies goes beyond the basics. She’s buying nap mats, backpacks, and fun extras that her kids will be excited to use.

“We’ve spoken a lot about going back to school,” London said. “They’re actually excited about the backpack itself.”

London is hoping to spend about $50 to $60 per child this year — and that’s just for school supplies, not clothing or shoes.

How much can tax-free weekend really save?

We priced out her preschooler’s list using online prices at H-E-B, with coupons applied. The subtotal came out to $125.90. With tax, that total jumped to $136.28 — more than double her target budget.

But by shopping during the Texas Sales Tax Holiday, London can save. Without the 6.25% sales tax, her total would drop to $127.90, a savings of $8.38 on just one child’s supplies.

“That’s another backpack, or socks, underwear, shirts, everything else we’re going to need,” she said.

With a second child’s list still ahead of her, she could be looking at roughly $20 in savings — money that goes a long way for families preparing for the new school year.

“I think it was great to break it down,” London said. “We’re probably going to go shopping this weekend.”

Texas Sales Tax Holiday 2025: What’s included

Friday, August 8 through Sunday, August 10

What qualifies:

Clothing and footwear under $100 per item (like jeans, t-shirts, and sneakers)

Backpacks, including roller-style and messenger bags (limit 10 per customer)

Basic school supplies, including:

- Binders

- Calculators

- Glue

- Notebooks

- Pencils

- Rulers

What’s still taxable:

Items over $100

Specialty athletic gear (e.g., cleats, football pads — sneakers are exempt)

Accessories, such as:

- Watches

- Purses

- Umbrellas

- Luggage

- Laptop/computer bags

Electronics, including:

- Textbooks

- Software

- Computers

Helpful tips

- Online orders count if payment is processed during the tax-free weekend.

- Shipping fees apply to the $100 limit. A $95 item with $10 shipping becomes taxable.

- If you accidentally pay tax on a qualifying item, you can request a refund from the retailer or file a claim with the Texas Comptroller’s Office.